How to Use the Amortization Schedule Calculator

The amortization calculator is a simple and easy-to-use tool to calculate the monthly repayment plan and total interest paid, as well as the date that you may be debt free!

Amortization is repaying a financial obligation in time in equivalent installations. The component of each repayment approaches the car loan principal, and also the component approaches the rate of interest. As the funding amortizes, the quantity approaching primary starts tiny, and also progressively enlarges month by month.

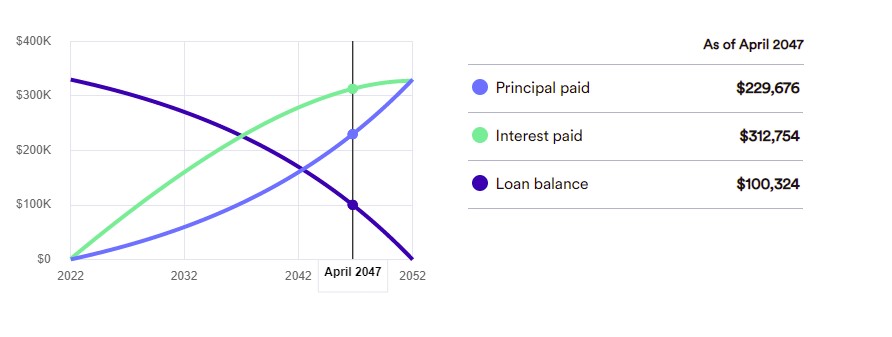

In an amortization timetable, you can see just how much cash you pay in principal as well as passion in time. Utilize this calculator to input the information of your financing and also see exactly how those settlements damage down over your funding term.

How payments change over the life of a 30-year loan

As regards your home loan proceeds, a bigger share of your repayment approaches paying for the principal up until the funding is paid completely at the end of your term.

What is amortization?

Every month, your home mortgage settlement goes in the direction of repaying the quantity you obtained, plus the rate of interest, along with the house owner’s insurance policy and also real estate tax. Throughout the funding term, the section that you pay in the direction of the principal, as well as the rate of interest, will certainly differ according to an amortization timetable.

If you secure a fixed-rate home loan, you’ll settle the financing in equivalent installations, yet nevertheless, the quantity that goes in the direction of the principal and also the quantity that goes in the direction of the rate of interest will certainly vary each time you make a repayment.

Throughout the lending, you’ll begin to have a greater portion of the repayment going in the direction of the principal as well as a reduced percentage of the settlement going in the direction of passion. With a longer amortization duration, your regular monthly settlement will certainly be reduced, because there’s even more time to settle.

The drawback is that you’ll invest much more on the rate of interest and also will certainly require even more time to minimize the primary equilibrium, so you will certainly develop equity in your house extra gradually.

What is an amortization schedule?

At first, the majority of your settlement approaches the rate of interest as opposed to the principal. The lending amortization timetable will certainly reveal as regards your finance advances, that a bigger share of your repayment approaches paying for the principal till the lending is paid completely at the end of your term.

A home mortgage amortization routine is a table that details each normal settlement on a home mortgage gradually. A part of each settlement is used towards the primary equilibrium as well as passion, as well as the mortgage amortization routine information on just how much will certainly approach each part of your home loan repayment.

How do you calculate amortization?

An amortization timetable calculator reveals:

How much principal as well as the rate of interest is paid in any kind of specific repayment.

Just how much overall principal and also passion have actually been paid on a defined day.

Just how much principal do you owe on the home loan on a defined day?

Just how much time you will certainly slice off completion of the home mortgage by making one or even more added settlements.

This indicates you can utilize the home loan amortization calculator to:

Determine just how much principal you owe currently, or will certainly owe at a future day.

Identify just how much added you would certainly require to pay on a monthly basis to pay back the complete home mortgage in, state, 22 years as opposed to 30 years.

See just how much passion you have actually paid over the life of the home mortgage, or throughout a certain year, though this might differ based upon when the loan provider obtains your settlements.

Find out just how much equity you have in your residence.

To make use of the calculator, input your home loan quantity, your home mortgage term (in months or years), as well as your rates of interest. You can additionally include added month-to-month repayments if you prepare for including additional settlements throughout the life of the finance.

The calculator will certainly inform you what your regular monthly settlement will certainly be and also just how much you’ll pay in passion over the life of the financing. On top of that, you’ll obtain a thorough routine that explains just how much you’ll pay in the direction of principal as well as passion every month as well as just how much superior primary equilibrium you’ll have monthly throughout the life of the car loan.

How do I calculate monthly mortgage payments?

Your month-to-month home loan settlements are identified by a variety of variables, including your principal financing quantity, month-to-month rates of interest, and also lending term. A greater rate of interest, greater primary equilibrium, as well as much longer finance term can all add to a bigger regular monthly settlement.

The monthly mortgage payment formula

Here’s a formula to calculate your monthly payments manually:

| Symbol | |

| M | the total monthly mortgage payment |

| P | the principal loan amount |

| r | your monthly interest rate Lenders provide you an annual rate so you’ll need to divide that figure by 12 (the number of months in a year) to get the monthly rate. If your interest rate is 5 percent, your monthly rate would be 0.004167 (0.05/12=0.004167). |

| n | A number of payments over the loan’s lifetime Multiply the number of years in your loan term by 12 (the number of months in a year) to get the number of payments for your loan. For example, a 30-year fixed mortgage would have 360 payments (30×12=360). |

Next steps in paying off your mortgage

If you intend to speed up the payback procedure, you can make twice monthly home loan repayments or added amounts towards a primary decrease monthly or whenever you such as. This method will certainly have a marginal effect on your spending plan, as well as it will certainly still assist you to conserve considerably on the rate of interest.

If you can obtain a reduced rate of interest or a much shorter finance term, you may intend to re-finance your home mortgage. Refinancing sustains substantial closing prices, so make certain to examine whether the quantity you conserve will certainly surpass those in advance costs.

An additional choice is home mortgage recasting, where you protect your existing car loan and also pay a round figure in the direction of the principal, and also your lending institution will certainly produce a brand-new amortization timetable mirroring the existing equilibrium. Your car loan term, as well as rates of interest, will certainly stay the very same, however, your month-to-month settlement will certainly be reduced. With charges around $200-$300, modifying can be a less expensive option to refinance.

Last but not least, a mortgage alteration brings the mortgage existing for consumers experiencing financial challenges. While a funding alteration could permit you to end up being mortgage-free quicker, and also can lower your rate of interest concern too, this choice might adversely influence your credit history.

The amortization schedule calculator is a great tool to use when you are trying to figure out your monthly mortgage payments. It is important to remember that this calculator is only an estimate, and your actual payment may be different. This calculator can help you get an idea of what your payments will be, and it is a good starting point when you are considering taking out a mortgage.

By inputting your loan information, you can calculate how much you will need to pay each month to make sure the loan is paid off within the desired time frame. You can also see how extra payments can impact your amortization schedule and help you pay off the loan even faster. Give it a try today and see how quickly you could be debt-free!