How to calculate your mortgage payments

Back in the day, when you first signed the mortgage papers, your lender would have given you an estimate of what your monthly mortgage payment could be. But when you bought a house and finally got around to calculating those numbers, these estimates often turned out to be wildly off.

This mortgage calculator can help you make the right decision on which mortgage to get. It contains different features, such as interest rate, term of the loan, regular monthly payment, principal and balance, and amortization table.

How to calculate your mortgage payments

The mathematics behind home mortgage repayments is complex, yet Bankrate’s Mortgage Calculator makes this mathematics trouble fast and very easy.

Initially, beside the room identified “Home cost,” go into the cost (if you’re getting it) or the present worth of your residence (if you’re refinancing).

In the “Down repayment” area, key in the quantity of your deposit (if you’re getting it) or the amount of equity you have (if you’re refinancing). A warranty is cash you pay ahead of time for a residence, and residence equity is the home’s worth minus what you owe. You can go into either a buck quantity or the percent of the acquisition rate you’re taking down.

Next off, you’ll see “Length of lending.” Pick the term– typically 30 years, however perhaps 20, 15, or 10–, and our calculator readjusts the settlement routine.

Ultimately, in the “Interest price” box, get in the price you anticipate paying. Our calculator defaults to the current ordinary price. However, you can readjust the portion. Your price will certainly differ depending on whether you’re acquiring or re-financing.

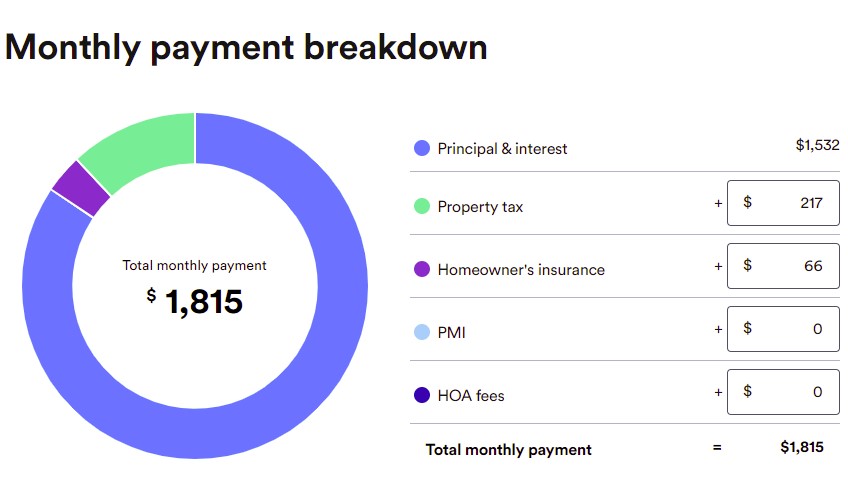

As you go into these numbers, a brand-new quantity for principal and interest rate will undoubtedly show up to the right. Bankrate’s calculator likewise approximates real estate tax, home owners’ insurance coverage, and property owners’ organization costs.

You can modify these quantities and even neglect them as you’re looking for a car loan– those prices could be rolled right into your escrow settlement. Yet, they do not impact your principal or interest rate as you discover alternatives.

Typical costs included in a mortgage payment

A huge part of your home loan repayment is the principal and also the passion. The principal is the quantity you obtained, while the rate of interest is the amount you pay the loan provider for obtaining it. Your lending institution likewise may gather an added quantity on a monthly basis to take into escrow, cash that the loan provider (or servicer) usually pays straight to the regional real estate tax collection agency and also to your insurance coverage service provider.

- Principal: This is the amount you borrowed from the lender.

- Interest: This is what the lending institution costs you to offer you the cash. Rates of interest are revealed as a yearly portion.

- Property taxes: Local authorities examine a yearly tax obligation on your residential property. If you have an escrow account, you pay one-twelfth of your yearly tax obligation costs with each regular monthly home mortgage repayment.

- Homeowners insurance: Your insurance coverage can cover damages and also economic losses from fire, tornados, burglary, a tree dropping on your residence as well as various other risks. If you stay in a disaster area, you’ll have an added plan, as well as if you’re in Hurricane Alley or quake nation, you may have a 3rd insurance coverage. Similar to real estate tax, you pay one-twelfth of your yearly insurance coverage costs monthly, as well as your lending institution or servicer, pays the costs when it’s due.

- Mortgage insurance: If your deposit is much less than 20 percent of the residence’s acquisition rate, you’ll most likely get on the hook for a home mortgage insurance policy, which additionally is included in your regular monthly settlement.

Mortgage payment formula

Want to determine just how much your regular monthly home mortgage repayment will be? For the mathematically likely, below’s a formula to assist you to determine home mortgage repayments by hand:

Equation for mortgage payments

Uint.co/wp-content/uploads/2022/07/Equation-for-mortgage-payments.jpg” alt=”” width=”433″ height=”211″ />

| Symbol | |

|---|---|

| M | the total monthly mortgage payment |

| P | the principal loan amount |

| r | your monthly interest rate Lenders provide you an annual rate so you’ll need to divide that figure by 12 (the number of months in a year) to get the monthly rate. If your interest rate is 5 percent, your monthly rate would be 0.004167 (0.05/12=0.004167). |

| n | Number of payments over the loan’s lifetime Multiply the number of years in your loan term by 12 (the number of months in a year) to get the number of payments for your loan. For example, a 30-year fixed mortgage would have 360 payments (30×12=360). |

This formula can aid you in problem the numbers to see just how much residence you can pay for. Utilizing our Mortgage Calculator can take the job out of it for you and also assist you to choose whether you’re placing adequate cash down or if you can or need to readjust your car loan term. It’s constantly a great concept to rate-shop with numerous loan providers to guarantee you’re obtaining the most effective offer offered.

How a mortgage calculator can help

As you establish your real estate budget plan, identifying your regular monthly residence repayment is important– it will possibly be your biggest persisting expenditure. As you buy an acquisition funding or a re-finance, Bankrate’s Mortgage Calculator enables you to approximate your home mortgage repayment. To research numerous circumstances, simply transform the information you participate in the calculator. The calculator can aid you to determine:

The funding size that’s right for you. If your spending plan is taken care of, a 30-year fixed-rate home mortgage is possibly the ideal telephone call. These financings featured reduced month-to-month settlements, although you’ll pay even more rate of interest throughout the training course of the financing. If you have some space in your spending plan, a 15-year fixed-rate home loan lowers the complete rate of interest you’ll pay, yet your month-to-month settlement will certainly be greater.

If an ARM is an excellent choice. As prices increase, it could be appealing to select a variable-rate mortgage (ARM). Preliminary prices for ARMs are usually less than those for their standard equivalents. A 5/6 ARM– which brings a set price for 5 years, after that readjusts every 6 months– may be the appropriate option if you intend to remain in your house for simply a couple of years. Nonetheless, pay attention to just how much your regular monthly home loan settlement can transform when the initial price runs out.

If you’re investing greater than you can manage. The Mortgage Calculator offers an introduction to just how much you can anticipate paying every month, consisting of tax obligations as well as insurance coverage.

Just how much to take down. While 20 percent is considered the required deposit, it’s not needed. Numerous debtors place down as bit as 3 percent.

Deciding how much house you can afford

If you’re not exactly sure just how much of your earnings needs to approach real estate, adhere to the reliable 28/36 percent regulation. Several monetary consultants think that you must not invest greater than 28 percent of your gross earnings on real estate prices, such as rental fees or a home mortgage repayment, and you ought to not invest greater than 36 percent of your gross earnings on a total financial obligation, consisting of home loan settlements, bank card, trainee car loans, clinical costs and so forth. Right here’s an instance of what this appears like:

Joe makes $60,000 a year. That’s a gross monthly income of $5,000 a month. $5,000 x 0.28 = $1,400 total monthly mortgage payment (PITI).

Joe’s complete month-to-month home loan repayments– consisting of principal, rate of interest, tax obligations as well as an insurance policy– should not go beyond $1,400 monthly. That’s an optimum finance quantity of about $253,379. While you can get a home mortgage with a debt-to-income (DTI) proportion of as much as 50 percent for some car loans, investing such a big percent of your revenue on financial debt could leave you without adequate shake area in your allocate various other living costs, retired life, emergency situation cost savings and also optional investing.

Lenders do not take those spending plan things right into account when they preapprove you for financing, so you require to factor those expenditures right into your real estate cost photo on your own. As soon as you recognize what you can pay for, you can take economically audio following actions.

The last point you wish to do is to delve into a 30-year home mortgage that’s as well pricey for your spending plan, also if a lending institution agrees to finance you the cash. Bankrate’s How Much House Can I manage Calculator will certainly aid you to go through the numbers.

How to lower your monthly mortgage payment

If the month-to-month repayment you’re seeing in our calculator looks a little bit unreachable, you can attempt some techniques to minimize the hit. Have fun with a few of these variables:

Select a much longer funding. With a longer term, your settlement will certainly be reduced (however you’ll pay even more rate of interest over the life of the financing).

Invest much less on the residence. Loaning much less equates to a smaller sized regular monthly home loan repayment.

Stay clear of PMI. A deposit of 20 percent or even more (or when it comes to a refi, equity of 20 percent or even more) obtains you off the hook for exclusive home mortgage insurance policy (PMI).

Look for a reduced rate of interest. Know, however, that some super-low prices need you to pay factors, an in advance expense.

Make a larger deposit. This is an additional means to decrease the dimension of the funding.

Next steps

A home mortgage calculator is a springboard to aiding you to approximate your month-to-month home loan settlement as well as comprehending what it consists of. Your following action after checking out the numbers:

Obtain pre-approved by a home mortgage loan provider. If you’re buying a residence, this is a must.

Obtain a home mortgage. After a lending institution has actually vetted your work, earnings, credit score, and also funds, you’ll have a far better concept of just how much you can obtain. You’ll additionally have a more clear suggestion of just how much cash you’ll require to give the closing table.

Mortgage calculator: Alternative uses

Most individuals utilize a home mortgage calculator to approximate the repayment on a brand-new home loan, yet it can be made use of for various other functions, as well. Right here are a few other usages:

Planning to settle your home loan early

Make use of the “Extra settlements” performance of Bankrate’s home loan calculator to discover exactly how you can reduce your term as well as conserve even more over the long-run by paying additional money towards your car loan’s principal. You can make these additional settlements monthly, each year or perhaps simply one-time.

To compute the cost savings, click the “Amortization/ Payment Schedule” web link as well as get in a theoretical quantity right into among the repayment groups (monthly, annual or single), after that click “Apply Extra Payments” to see just how much rate of interest you’ll wind up paying as well as your brand-new reward day. equity.

Decide if an ARM deserves the danger.

The reduced preliminary rate of interest of a variable-rate mortgage, or ARM, can be alluring. While an ARM might be proper for some consumers, others might discover that the reduced preliminary rate of interest will not reduce their month-to-month settlements as high as they assume.

To obtain a suggestion of just how much you’ll actually conserve at first, attempt getting in the ARM rates of interest right into the home loan calculator, leaving the term as 30 years. After that, contrast those repayments to the repayments you obtain when you go into the price for a traditional 30-year set home loan. Doing so might verify your preliminary hopes concerning the advantages of an ARM– or provide you a fact check regarding whether the prospective plusses of an ARM actually exceed the threats.

Figure out when to remove exclusive home loan insurance coverage.

You can make use of the home loan calculator to identify when you’ll have 20 percent equity in your house. That’s the magic number for asking for that a lending institution forgo its personal home mortgage insurance coverage demand.

If you place much less than 20 percent down when you bought the residence, you’ll require to pay an added cost monthly in addition to your routine home mortgage repayment to balance out the lending institution’s danger. When you have 20 percent equity, that charge disappears, which implies even more cash in your pocket.

Merely go into in the initial quantity of your home loan as well as the day you shut, and also click “Show Amortization Schedule.” After that, increase your initial home loan quantity by 0.8 as well as match the outcome to the closest number on the reactionary column of the amortization table to discover when you’ll get to 20 percent.

Terms discussed

Utilizing an on the internet home loan calculator can assist you promptly and also properly anticipate your regular monthly home mortgage settlement with simply a couple of items of info. It can likewise reveal you the overall quantity of rate of interest you”ll pay over the life of your home mortgage. To utilize this calculator, you”ll require the adhering to info:

Home cost – This is the buck quantity you anticipate to spend for a residence.

Deposit – The deposit is cash you provide to the house’s vendor. At the very least 20 percent down generally allows you prevent home mortgage insurance policy.

Lending quantity – If you’re obtaining a home mortgage to acquire a brand-new residence, you can discover this number by deducting your deposit from the house’s cost. If you’re re-financing, this number will certainly be the impressive equilibrium on your home loan.

Financing term (years) – This is the size of the home loan you’re thinking about. As an example, if you’re purchasing a house, you may pick a mortgage that lasts 30 years, which is one of the most typical, as it enables reduced month-to-month settlements by extending the payment duration out over 3 years.

On the various other hand, a property owner that is re-financing might choose a lending with a much shorter payment duration, like 15 years. This is an additional typical home loan term that permits the customer to conserve cash by paying much less complete rate of interest. Nevertheless, month-to-month settlements are greater on 15-year home mortgages than 30-year ones, so it can be even more of a go for the home budget plan, particularly for new property buyers.

Rates of interest – Estimate the rates of interest on a brand-new home loan by examining Bankrate’s home mortgage price tables for your location. When you have actually a forecasted price (your real-life price might be various relying on your general economic as well as credit report image), you can connect it right into the calculator.

Funding beginning day – Select the month, day and also year when your home loan repayments will certainly begin.

Calculating your mortgage payments is a crucial step in the home buying process. With a little help from an online calculator and some patience, you can easily calculate your monthly mortgage payments. Once you know how much you’ll be paying each month, you can start budgeting for other expenses and save up for a down payment. With a little bit of planning, you’ll be on your way to homeownership in no time.

Whichever method you choose, make sure you consider all the variables so that you get an accurate estimate of your future payments. We hope that this article has provided you with the information you need to calculate your mortgage payments accurately.